Smart consumer communications cannot heavily rely on information alone; consumers can only gain financial empowerment if financial service companies modernise content offerings. In a consultation paper the Financial Conduct Authority (FCA) urge companies to challenge risk-averse approaches to content creation, so that consumers are able to make better financial decisions.

The accompanying discussion paper published (well worth reading) explains that common barriers by financial services firms looking to improve consumer communications include:

- ‘Risk-averse’ approaches to communication design, often using consumer disclosures as a risk-management tool to mitigate potential action against the company;

- Struggling to weigh-up jargon-filled lengthy disclosures that are required by EU and domestic legislation, as well as providing clear instructions to consumers;

- The cost of organisational change may not be worth it for potential benefits;

- Communication taking second-place priority alongside product and service design.

As the FCA rightly challenge,

“We do not consider these perceived barriers sufficient reason that firms should not give greater priority to developing effective consumer communications and believe firms should both challenge these behaviours in their companies and that, we as a regulator, should support this.”

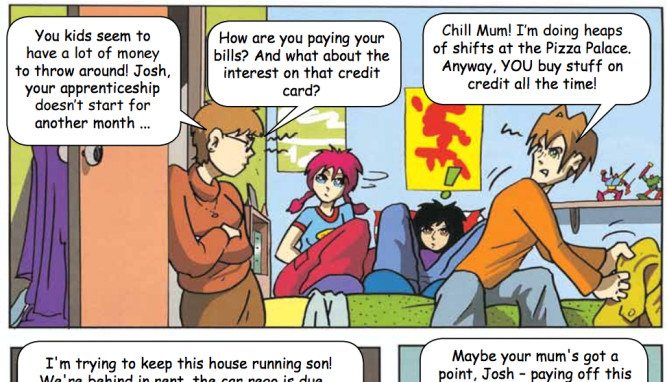

The discussion paper includes inspirational examples of companies that are communicating with customers, including a video from Aviva and how the Australian Securities and Investment Commission (ASIC) developed a series of comics to educate consumers.

The discussion paper and consultation seems to signpost an ongoing ‘digital revolution’ at the FCA to challenge firms on updating how they approach communications in an age of social media. At the start of this year the FCA released their guidance on social media and customer communications, something we suggest should impact the FCA’s current smart consumer communications discussions.

Social media provides the means for companies to produce interactive infographics, engaging videos, and engaging social media updates; we work with a range of banks each day pushing social innovation forward. However, creativity isn’t the only ingredient required for smart consumer communications, the real benefit will be found through linking customer records with data from social media.

For example, last week Twitter revealed that it’s improving the way customer services run on its service by allowing companies to link up customer phone numbers or Twitter credentials with a CRM. This will then allow companies to track user interactions, matching Twitter handles to specific customer accounts; this could flag customers having persistent problems or questions. Twitter has also developed a service known as “single-tweet resolutions” — as a user’s Twitter account will be linked up with their purchase account, a customer service rep will be able to see purchase history and offer direct and specific advice over Twitter in response to questions.

For financial services firms this could mean a personalised social media system for managing customer enquiries or organising B2B requests from other stakeholders. It’s an example of smart consumer communication through updating internal organisation processes; a ‘risk-averse’ approach may just mean the competition can jump ahead.

As we all recognise, the biggest challenge when creatively tackling the challenge of consumer communication isn’t necessarily through organisation skill gaps. Instead it’s reinvigorating the culture of an organisation so that risk-adverse becomes secondary to clear and transparent communications – consumers are put first.

The overwhelming messages we’re getting from the FCA on smarter communications is clear; it’s time for better collaboration across the financial services industry and to harness the opportunities provided by social media.